Did I Spend Too Much On My House Money Pit Houses

Whether y'all want to hear it or not, some houses are just money pits. Many people buy houses at the top of their budgets and don't consider all the costs. Here'south how to make sure you don't practice that.

"Here lies Walter Fielding. He bought a house, and information technology killed him."

This quote, from the oral fissure of Tom Hanks' character in the 1986 comedyThe Money Pit, might sum upwardly the homeownership experience of millions of Americans: disenchanting, frustrating, expensive. And peradventure ruinous.

The American Dream promises that anyone willing to put in difficult work has a shot at a better life than their parents. Just I believe the archetype of the American Dream has traditionally included sure material trappings: a reliable car, family unit vacations, and of course, one'southward own dwelling, ideally encircled by a white lookout debate.

Of grade, this archetype is changing, and speedily.

Older generations criticize younger Americans for nigh everything. Only the Millennial-inspired trends of delaying (or eschewing birthday) matrimony and suburban homeownership in favor of balanced careers, travel, and more sustainable urban lifestyles are factors likely to peculiarly draw the ire of your curmudgeonly uncle.

Of course, it's easy for united states of america younger Americans to see a new reality. In an era of stagnant wages, ballooning pedagogy costs, and student debt burdens, prohibitive healthcare costs, disappearing benefits, and the specter of climate modify threatening futurity generations' very existence, why would all of us knowingly chase a materialistic dream involving an expensive and inefficient suburban McMansion that requires two gas-guzzling cars in order to commute many smoggy miles in soul-crushing traffic to a meaningless corporate task?

According to a survey by Bankrate conducted in January 2019, nearly half of all homeowners have buyer's remorse. Among all homeowners, 44 percent take some regrets. Among Millennials, nevertheless, the number of homeowners with remorse rises to a shocking 63 percentage.

Although homeowners accept regrets for dissimilar reasons including, for example, buying a home that'southward either too large or also small, the number one reason for regretting the buy was that maintenance and other costs involved in owning the home turned out to be more than expensive than expected. Ah,The Money Pit.

In the sections that follow, nosotros're going to accept a look at three of the near pervasive myths in American real estate: That homeownership makes yous happy, homeownership makes you wealthy and, finally, that renting makes you a sucker.

Afterwards, we'll take a expect at a few exceptions and lay out some all-time practices you can utilise — whether you're a prospective buyer or current homeowner — to make the best decision possible or, at to the lowest degree, brand the best of an ambiguous situation.

This is a long, in-depth article. Information technology could have every bit much as 45 minutes to get through. Stick with me though, information technology'due south going to be an interesting read!

Myth 1: The myth of the happy homeowner

If you have whatsoever doubt that popular civilization is selling us a vision of home-ownership bliss, spend an 60 minutes watching any number of Television receiver shows on HGTV and dozens of other networks such every bit "Fixer Upper", "Home Town", "Belongings Brothers", "Love It Or List It", and and so on.

These shows feature unusually attractive hosts with diverse backgrounds in real estate, construction, and interior decorating helping wide-eyed homebuyers buy, and often renovate, the perfect domicile.

Like all reality television, I believe these real manor shows paint a picture of homeownership that'southward unrealistic at best and dangerous at worst. As someone who has endemic three unlike homes and renovated office of one, these shows infuriate me for many reasons.

Renovating a home is INCREDIBLY expensive

Beginning of all, most shows feature young couples with head-scratching budgets. (How, exactly, practice these 26-twelvemonth-olds in a ubiquitous American small town accept $800,000 to driblet?) Nosotros rarely discover out and are instead left wondering if they're genuinely that successful, if there's a trust fund involved, or if they're simply making the potentially catastrophic decision to overspend.

Side by side comes the illusion that gutting a home to its studs and rebuilding is a job that can be completed in a few weeks on a laughably modest budget. The renovation costs quoted on these shows are routinely half — sometimes less — of the quotes we receive for like projects.

I'm willing to concede that I live in a region with a small pool of contractors and higher structure costs. Still, the quoted remodeling costs on these shows are insanely low. Never mind that the production companies furnish 24/7 work crews to complete the projects in a 10th of the time the average homeowner might exist able to.

There are ever subconscious costs

If there'due south one shred of reality in these reality shows, it's that the hosts oft return to the buyers with a long face and the words "and so there's some bad news."

Surprise, surprise, there are almost e'er hidden costs lurking inside the walls of an crumbling domicile. They might range from a couple one thousand dollars to supervene upon a rotted subfloor to tens of thousands to correct a structural consequence or rewire an unabridged abode with unsafe electrical piece of work.

Domicile improvement shows don't show us the reality of the situation

Bated from these faults I observe with these shows, the shows are even more than misleading because of what they never show u.s.a.:

- The homebuyers collaboratively deciding how much to spend on the habitation

- How much of the buy cost the homeowners will demand to borrow, and how much the corresponding mortgage payment will impact their monthly budget

- The costs of hiring designers and general contractors to oversee the renovation. (Clearly, the tv shows probably encompass this expense. But it'due south a very real and very meaning cost to anyone not willing to practice everything themselves.)

- When things become over upkeep, where the money comes from?

- What happens after the show wraps? Does the construction hold up? It'southward frequently obvious that the renovation makes a portion of the home Pinterest-perfect, while leaving other sections of the home (sometimes an entire level) untouched and unphotographed. What other repairs lurk there? What will it cost to maintain the newly-installed landscaping or renovated pool? How much will the renovation increase the possessor'due south belongings taxes? (Assessments, later on all, fluctuate with the status of the property.)

Now, we've got more important things to cover here than debunking the notion of reality in reality TV. But I call out these dwelling house improvement TV shows to illustrate the illusion of the happy homeowner gleefully choosing paint and textile swatches without regard to the other obligations of everyday life, let alone financial reality.

How homeownership affect our happiness

It's been shown time and again that more than money does, in fact, brand people happier…but only to a signal. There is an amount of annual income with which people are measurably happier than people earning less. The exact amount changes regionally with the cost of living and over time with inflation, only I've seen it described as anywhere betwixt $45,000 and $70,000 a year.

With any corporeality of income above this amount, happiness continues to increase gradually, but it quickly plateaus. Information technology could exist said that someone earning $150,000 a year is slightly happier than someone earning $70,000 a year, but someone earning $1 one thousand thousand a yr is well-nigh imperceptibly happier than someone earning $150,000, and resultantly, only marginally happier than the person earning $70,000!

And all the same, that person earning $70,000 is a great bargain happier than someone only earning $20,000 a twelvemonth.

This shouldn't be a huge surprise. Information technology's easy to imagine the sacrifices and anxieties of living nearly or below the poverty line ($25,750 in 2019 for a family of four). Yet, I think we all assume that we'd be happier with more income than we take today.

This psychology manifests itself when we purchase a home. Surely, nosotros'd be happier with a nicer neighborhood, a two-car garage, a flake of a back yard, an actress bedroom to use every bit an office, a finished basement.

Merely where does it stop? Would nosotros be happier with a high-end kitchen, with an acre of privacy, with a pool? What well-nigh a complete home-gym, a game room, or a moving-picture show theatre?

Allow's use me equally an case

If you doubtfulness me, let me explicate that I'm living proof of this fallacy. The success of certain parts of my business organisation has speedily increased my family's wealth over the final 10 years. And nosotros've moved twice.

The first time, we moved from a pocket-size habitation in a dense neighborhood (no privacy, no garage, for example) to an average home in a more upscale neighborhood. This second house had a nice location with a bit of privacy and a garage, just it was also an old business firm in need of repairs, and we sunk a lot of money into it.

Finally, information technology was the prospect of sinking a lot more than money into that house that led the states to our electric current home which, admittedly, is way more than we demand. Simply information technology was as well the house that met all our wants and saved the states from spending hundreds of thousands of dollars more in turning our one-time house into what nosotros wanted.

Perhaps I'm living an example of what I'm suggesting y'all think twice well-nigh. There are many days I dream of having less business firm to maintain, to clean, to pay belongings taxes on. But I'm also in a position to purchase the house without a mortgage and to afford the taxes and maintenance.

Does owning a nice abode brand me unhappy? No, definitely not. Only does it brand me any happier than owning a pocket-sized dwelling or fifty-fifty renting a modest condo? Probably non. While at that place are definitely perks to having the privacy and upscale amenities in our current home, I'll tell yous that any increases to happiness those bring me are starting time by the expenses and maintenance obligations.

I more example

I take all the same to see as poignant of an example of this absurdity as in Season iv, Episode iii of Arrested Development, in which Tobias and Lindsey determine to buy a dwelling with the help of a realtor named James Carr, played by Ed Helms.

Lindsey and Tobias explicate to Carr that they have no avails, no income, no credit and, honestly, no work ethic. Not a problem, Carr explains to them. He'll become them a NINJA Loan (No Income, No Jobs or Assets). They end up buying a 10,000+ square foot McMansion with non 1, merely 2 gatehouses.

It's a painfully funny scene in part because it's not every bit much of an exaggeration every bit it seems. This kind of thing happened every mean solar day in the years leading up to the mortgage crisis and the subsequent Peachy Recession of 2008.

While today, new federal laws and lending guidelines might limit the most egregious predatory mortgage lending, realtors and mortgage brokers continue to double-decker buyers into besides-expensive homes because at that place is no incentive not to.

Realtors and mortgage brokers earn their commission at the date of closing irrespective of whether the buyers can make even their first mortgage payment. Even the banks originating the loans might not intendance because they ofttimes plow around and sell the loan within 30 days.

It'southward important to remember all this when you lot're watching HGTV or going on showings with your realtor. A good realtor volition heed carefully to your budget requirements and work with yous to stay within them.

But you must never forget that at that place are multiple industries (real manor, construction, entertainment, home furnishings, home improvement retailers) spending billions of dollars each year to influence you and make you believe that buying a larger home, a newer dwelling, or a prettier abode will brand you happier.

Spoiler: Information technology won't. And it but might exercise the opposite.

Myth ii: The myth of the wealthy homeowner

At that place's a proficient take chances you lot know someone – perhaps a parent or another relative – who brags well-nigh buying their home thirty or forty years ago for $100,000 (maybe less) and how it's appreciated to a half-million dollars, or maybe more. These people may also be the ones giving you well-meaning advice like "end throwing your coin abroad on rent" or "buy a home equally soon as y'all can, information technology's the primal to financial success!"

Unfortunately, they're not telling the unabridged story. To be fair, it's not their fault; they don't realize, per se, they're giving bad advice.

Existent manor appreciation doesn't always hateful money in your pocket

In most cases, real manor does appreciate. And, over many decades, that appreciation appears to be significant.

But, hither's the thing: Over fourth dimension, the value of a dollar decreases due to inflation. And, when people brag about how much something has appreciated over multiple decades, they virtually never terminate to point out how much they would've paid for the house in today'south dollars. If they did, the numbers aren't going to sound nigh as dramatic because, well, they simply aren't.

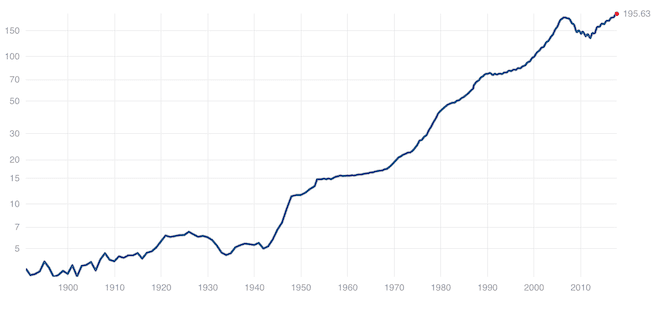

To illustrate this point, here's what the Case Schiller U.S. Dwelling Price Index looks like before being adjusted for inflation. (The Example Schiller Index is the most widely-used criterion for dwelling prices nationwide.)

Sort of impressive, correct? If you purchased a home around the twelvemonth 2000 and it appreciated similarly to the national average, the home's value would have doubled in about xx years. During other xx year periods in the last 120 years, values have risen even more than steeply.

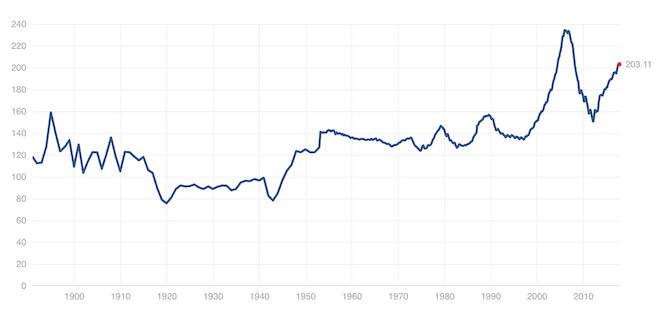

Just here, take a look a await at what the alphabetize looks similar adjusted for aggrandizement.

The inflation-adapted chart looks a lot different than the showtime. You should immediately notice two things:

- The dramatic appreciation, and subsequent crash, of habitation values leading up to and following 2005; and

- the long periods of relative minor fluctuations in value.

The lesson here is that real appreciation depends not only on home prices but on home prices in relation to inflation. While real appreciation is possible (see 1998 to 2005 and 2012 to today), it's much less mutual (and much less dramatic) than we believe when we don't take inflation into account.

When I expect at buying my own homes, I look at equity as an inflation-protected shop of value. I experience confident that I should be able to compensate what I paid for my dwelling house in aggrandizement-adapted dollars. Having home equity is better than having coin in a savings account, where interest rates rarely proceed upward with inflation, just I'm not counting on it to build wealth by generating returns above and beyond aggrandizement.

Now, I might go lucky and cease up selling in a chimera similar to 2005, just I'm non going to depository financial institution on that happening whatever more than than I can depository financial institution on winning a Powerball jackpot.

I'm going to sell my home when my personal circumstances change and I demand a different living situation.

Makes sense, right? Your house is a dwelling, not an investment. A house provides utility (a place to live). Information technology doesn't provide income (unless y'all somewhen own it and rent it). And it'southward not something you tin can easily sell into a hot market place and collect profits from appreciation Why? Because where are y'all going to live? Allow's say you practice sell your home into a hot market to pocket some appreciation. At present you need a new dwelling house, and y'all're going to accept to buy in that same hot existent estate market.

Yous may have to sell in a poor real manor market

Finally, permit's not ignore the risk of being required to sell your home into a poor real estate marketplace. We tend to forget that it's possible to lose money on your home as millions of people did following the mortgage crisis.

In the worst cases, people owed more than on their mortgages than their homes were worth. One report in 2011 estimated that, at the time, nearly half of mortgages in the United States were effectively underwater!

If you're still non convinced that your house is not a good investment, let'south talk well-nigh the carrying costs.

Conveying costs

At the very to the lowest degree, you lot'll need insurance on your home. In most parts of the land, you'll pay holding taxes on the house. Finally, even the nearly bones home volition require regular maintenance: Painting, cleaning, heating and cooling services, appliance replacements, lawn mowing, etc.

Basic maintenance might cost a couple m dollars a year, but major maintenance bug like exterior painting or a new roof pop up over time, calculation another few m a twelvemonth in amortized costs.

Even if your firm appreciates plenty to outpace aggrandizement and cover the realtor's commission when you sell, it'south still very unlikely the appreciation volition cover years of taxes, insurance, and maintenance. And I won't even get into upgrades and renovations.

When you add up all these factors, hopefully, information technology becomes clear that your home is not an investment!

What nigh home equity?

Since we're talking about the myth of the wealthy homeowner, we can't ignore dwelling house disinterestedness. If you buy a home outright for $100,000, y'all're out a hundred k in greenbacks, only y'all at present have an asset — your habitation — worth $100k. If the home appreciates twenty percent, y'all then have $120,000 equity in the abode.

Now, dwelling equity is real wealth: If you have $45,000 in abode equity, you can conceivably sell the house and employ that money. Of form, selling a business firm takes time, normally requires paying a realtor'southward commission, and requires that you exist ready to motility out.

Greenbacks-out refinance

Banks make this easy to do: Y'all can apply for a home equity loan, a dwelling house equity line of credit, or you lot can do a cash-out refinance in which you take out a new mortgage for more than you lot currently owe and receive a check for the difference.

If the idea of going out and swapping ane mortgage for a bigger 1 makes you uneasy, you've got skilful intuition. Mortgages are a necessary evil for about home buyers. As far every bit debts go, mortgages are better than other kinds of debt considering interest rates are reasonable and some of the involvement on your primary dwelling house is revenue enhancement-deductible.

Notwithstanding, I'm the kind of guy that would rather take no debt if I have the selection. Information technology's why I paid off my mortgage when I got the chance.

Not everybody agrees with this strategy. In that location'south an argument to be made that it's better to carry a mortgage at 4.25% and exist able to invest your actress cash in the stock market and earn 7%. That statement isn't wrong, it'due south just non one I'grand personally comfortable with.

I'grand willing to take risks past investing in the stock marketplace and existence an entrepreneur, just I balance that risk by being conservative in other areas of my fiscal life. By paying off my mortgage, I got a guaranteed four.25% return on my money, which is the kind of guarantee y'all can't get anywhere else.

That said, I have friends with enough of coin to pay off their mortgages, simply they don't. There'southward nix incorrect with that, as far as I'm concerned.

The problem, in my stance, is when homeowners treat their home equity like a checking account. Every bit foolish every bit it might seem today, this was incredibly common prior to the housing crisis ten years agone.

DON'T use equity like a checking account

Back and then, it wasn't at all uncommon for someone to buy a house and, a few years afterward, observe that the home's value had doubled. For example, someone who bought a $200,000 with a $150,000 mortgage now owes $140,000 on a dwelling that'southward worth $400,000.

They find they can hands get a $100,000 home disinterestedness line of credit which they utilise to put in a puddle (that doesn't really change the value of the home) and go on a few overnice vacations.

While it's never a good idea to go into more debt simply for the sake of more consumption, borrowing confronting your home carries the additional risk that the underlying asset will lose value. In the housing crisis, that's exactly what happened. I recall we tin can all picture a foreclosure sign in front of a McMansion with a driveway full of $150,000 worth of new cars, motorcycles, and jet skis.

In our prior instance, what happens when the homeowner with a $140,000 mortgage and $100,000 in home disinterestedness loans finds that her domicile value dropped from a high of $400K back to $200K? That's what she paid for the home, just she now owes $40,000 more than the dwelling house is worth!

Dwelling house equity may be used for an emergency fund (carefully)

The other affair nosotros so frequently run into with habitation equity is that older homeowners use it to fund their kids' college tuition or to pay for medical expenses and long-term care when they don't take other sources of savings.

Funding retirement expenses like medical costs or long-term care is a skillful use of dwelling equity when there are no other options. I would counsel people to rethink paying for college with that money for exactly that reason: If you lot don't take other assets, you lot're going to need that equity for the inevitable costs of growing erstwhile.

Myth 3: The myth of the foolish renter

Permit's presume you could live in the same house for $1,000 monthly hire or a $1,000 mortgage payment. Of the mortgage payment, about $600 will reduce the principal each month, and the rest is interest. On the one manus, owning a home seems to make sense because yous're keeping $600 a calendar month. The problem is, we're ignoring all the other costs of homeownership.

There are many other points to consider, just here are what I believe to be the two most meaning:

- If you only live in your dwelling for five years or less, much or all of your equity will be erased by realtor commissions and closing costs on a new habitation

- As we've mentioned, your domicile equity isn't liquid

Yep, home equity is existent wealth. But achieving a net positive consequence in owning your domicile versus renting only works if yous stay in your abode for decades, not years.

The suspension-even point is a moving target and depends entirely on the relative costs of renting and owning equivalent properties in your metropolis. Believe it or non, sure markets tin can wildly favor buying and others tin can wildly favor renting. It all depends on how things are priced at the moment. That said, I've establish that five years tends to be most the break-even point in many average scenarios.

Effort out our hire-versus-buy calculator to become a sense of how long y'all might take to live somewhere for buying to make sense financially.

Renting is, actually, pretty sweet

The financial benefits of owning your home are real just frequently oversold. Possibly but as of import, still, are the non-fiscal benefits to renting.

Obviously, renting gives you flexibility. Most leases are just a twelvemonth long. Most of us rent for at least a few years in early adulthood not only considering renting an apartment requires less cash upfront than a down payment on a home, but also considering nosotros're in the process of trying out dissimilar jobs and neighborhoods, or perhaps unabridged cities.

Renting frees you lot from the responsibilities of maintenance. When I first bought our house, I couldn't wait to bulldoze down to Home Depot and buy my very ain lawnmower. Years after, I at present happily pay someone to mow the backyard for me and then I can reclaim two hours a week every summer. Never mind the thousands of dollars we've spent on plumbing leaks, basement flooding, worn-out appliances, and other expenses.

I'm somewhat handy and there are times I savour a skillful DIY project. But between two careers, two kids, aging parents, and trying to detect some fourth dimension for fun, working on the house is rarely the thing I want to exist doing most. There are definitely days I would kill to just exist able to telephone call a landlord.

Bated from the reduced responsibilities, renting can actually make financial sense. Equally I mentioned above, it all depends on your regional real estate marketplace. If yous're someplace where you can rent an flat more cheaply than y'all could own a home, you can invest the deviation, even so modest that divergence is.

For example, let's say yous rent for $1,000 but would have to pay a $1,300 mortgage payment on a comparable home. That'd $3,600 each year that you tin can save or invest. Different value that accumulates every bit home equity, those savings are liquid. They can pad your emergency fund, pay off student loans, or fund an IRA.

Renting is not wasted money! Although there is a fiscal argument to exist made for buying a home where you'll live for 10 years or more, you shouldn't feel any pressure to rush into homeownership, especially if you lot doubtable yous'll desire to motion effectually a fleck in the near future.

And so, yous yet want to purchase a dwelling house

As I've ofttimes said in prior articles well-nigh the false promises of homeownership, I know many of yous are going to get out and purchase a domicile anyhow. Later on all, homeownership is almost never just a financial decision…a dwelling house represents a portion of our hopes and dreams and, ultimately, is one of the most useful things nosotros ever ain.

Hopefully, yous avoid buying too apace and then selling likewise soon. This comes back to understanding that information technology usually takes at least v years to suspension fifty-fifty on owning a home. The longer you lot live in a domicile, the better you'll do compared to renting.

How much to spend on a domicile

The unmarried biggest factor in how homeownership will affect yous is how much you cull to spend. Now, this is relative to your income. A $2 million domicile would bankrupt about people just might be totally reasonable for someone earning $800,000 a twelvemonth. As well, a $200,000 home could hands prove difficult to beget for someone earning $50,000 or less.

Banks will approve borrowers for mortgages that cost upward to 35 per centum of your pre-tax monthly income. For example, they might give a couple who earns $100k a year a mortgage with a monthly payment close to $three,000. When you cistron in the taxes the couple pays on their income, however, that mortgage volition end up beingness nearly 50 per centum of their tax-home pay, leaving only most $three,000 for all of their other monthly expenses.

Spend no more than 20-25% of your monthly income

I recommend trying to spend no more than than 20 to 25 per centum of your gross monthly income on housing. You can utilize our domicile affordability calculator to run some scenarios and see how much business firm you could beget, adjusting for involvement rate and down payment. It might exist less than y'all idea or hoped. But but remember: The less you spend on your mortgage, the more money you accept for everything else.

It's extremely difficult to balance fiscal stewardship with the emotional draws of your dream abode (and a realtor's sales pitch). Just remember that, in the long run, having a small-scale dwelling you tin comfortably beget is far better than having an incredible home you tin't afford.

Your down payment

In one case upon a time, ownership a dwelling required a 20 percent down payment. Simply, as housing has become more expensive and lending more competitive, downward payment requirements take plummeted. Ten per centum downwardly payments are common, and federal programs like FHA and VA loans allow people to buy a domicile with as piffling as 3.five percentage down.

Choosing the right amount to put down is a balancing act.

In a perfect world, putting 20 pct down is still ideal because it provides the all-time insurance and helps make sure that your mortgage won't fall underwater due to a sudden reject in abode values.

That way, you tin notwithstanding sell your habitation and walk away if you need to. Down payments of less than twenty percent increment the take a chance that your mortgage could fall underwater, and information technology'southward why about banks will require individual mortgage insurance (PMI) for smaller down payments. eastward.

Still, you don't want to use all of your available greenbacks on your down payment. Far as well often, I see people use every concluding penny they have on their down payment and endmost costs, only to move in and go into credit card debt just to be able to afford furniture and the inevitable dwelling improvement projects that immediately become "priorities" when y'all move into anything but a newly-constructed house.

Ideally, you should exist able to brand a downwardly payment and all the same take

- An emergency fund with a minimum of three months' living expenses (which you will later rebuild to six months')

- A reasonable budget for article of furniture, interior pattern and/or unforeseen improvement projects

For a couple who has $fifty,000 saved and $3,500 in monthly expenses buying a $200,000 habitation, that looks like:

- $10,500 minimum emergency fund

- $7,500 in home comeback upkeep

- $32,000 remaining for the down payment (xvi percentage of $200k)

Your interest rate

I won't spend a lot of time talking about the importance of edifice good credit and its effect on your mortgage rate simply because Coin Nether xxx has covered information technology so extensively elsewhere.

Surprisingly, there is more wiggle-room for less-than-perfect credit when buying a home as compared to, say, applying for a credit card. Borrowers with credit blemishes may still be able to go approved for a mortgage. The affair is, information technology will be a lot more than expensive.

Y'all'll want a credit score that'due south at to the lowest degree in the low 700s to obtain the best mortgage rates available.

That'southward because seemingly tiny differences in mortgage rates can add up to tens of thousands of dollars in boosted involvement over the lifetime of your loan.

Conveying costs

Factors ranging from property taxes to the age of a home equate to dramatic differences in the carrying costs you'll pay to alive in that location.

Belongings taxes

Where I alive in Maine, property taxes are a significant consideration. When shopping for our current home, nosotros passed on several beautiful homes that were no more than expensive than the home we ultimately bought only had notably college almanac property taxes.

At that place are numerous factors that affect your property taxes to accept into business relationship. If you program to accept kids and holding taxes pay for better-than-average schools, paying more than in tax can be smart considering information technology's usually a lot cheaper than private school tuition.

New construction taxes

Other factors to watch out for are the fact that new structure tends to be taxed at a college rate and how the location of your lot impacts property tax. I alive in a coastal town where holding taxes about the bounding main can be double the taxes on an equivalent habitation merely a half-mile inland. And if the business firm has actual ocean frontage, forget about it — the tax bills get downright ridiculous.

HOA fees

Homeowner'south association fees are another consideration. Often times, HOA fees provide a proficient way to budget for shared maintenance, but other times you may be paying for services y'all don't need. Either way, you're taking on an expense that isn't entirely within your control.

Whether or non you pay an clan fee, there volition be some maintenance items y'all'll need to handle yourself.

Market conditions

When buying your ain home, you may non have the luxury of trying to time your entry into the local existent manor market equally if you were, say, going to try your mitt at purchasing and managing an investment holding. You're probable going to purchase when you lot've saved enough coin and information technology makes sense to move.

Make sure you have a proficient real estate agent

Notwithstanding, if you detect yourself house hunting and feeling pressure from realtors to submit offers after seeing a house just once, have a breath. When there's a seller'due south market, buyers not just end upward paying more to get a home, they end up needing to make decisions very quickly. When you lot're ownership something equally expensive and important to your life equally a dwelling house, that's not ideal!

A proficient realtor volition help yous strategize, even if it means delaying your shopping until market place conditions have cooled. Exist wary of a realtor who is pushing you to enter multiple-bid situations anyhow later you've explained y'all don't Accept to buy today. Nearly realtors volition work with your best interest in mind, but some may put their desire for a quick commission in the driver's seat.

Expect for homes that have been on the market for a while

If you have some tolerance for making home improvements or settling for a slightly out-of-date home, look for homes that have been on the marketplace for several months. Y'all're definitely more likely to avoid a competitive bid situation and may find sellers who are willing to negotiate quite a bit on their asking price. In the same vein, spring and summer tend to be the most favorable seasons for sellers. Every bit a buyer, you may observe less inventory in fall and winter, just you lot'll also accept less competition.

You may want to await for the marketplace to cool

Finally, simply as you may not be able to avoid buying into a hot real estate market entirely, you won't know where a market bottom is going to be, either. Waiting until a super-hot marketplace cools isn't a bad thought, just if y'all attempt to time the market bottom you may just end up waiting around for years or realize one day that you've missed information technology and prices are affectionate again.

For the most part, time your home ownership based on your needs and fiscal situation, not the market place.

Summary

Buying your commencement home is incredibly exciting, just it's also, most probable, the largest financial decision of your life to date. And, despite all the curmudgeonly cautions I've laid out here, being a homeowner is still an incredible privilege and experience that I hope yous get to experience (if you want to).

I hope you'll accept abroad the post-obit:

- Buy a abode considering you lot want to exist a homeowner and when yous're financially prepared to exist a homeowner.

- Wait to buy a home until you can exist reasonably sure y'all won't demand to move or sell the home for at least five years.

- Do not stretch to buy a home before you lot're set because you lot speculate yous might "make it on the ground floor" and savor rapid appreciation in your habitation's value and equity.

- Practise not look at your dwelling equally an investment or sacrifice other necessary financial goals like debt repayment and retirement savings to make buying a dwelling possible.

- Exercise non underestimate the carrying costs of a abode or the less obvious lifestyle costs that volition pop up when you decide you desire to redecorate; buy new furniture, or improve your landscaping.

- In the meantime, don't feel bad about renting!

A house tin can absolutely exist a money pit. But, it can as well exist the all-time thing you ever buy: A place to relax, to entertain, to raise a family. Your personal sanctuary in a crazy world.

Your goal should be to relish all of those benefits of homeownership while minimizing the toll and financial risk. Only as with any financial decision, take your time to get it right.

Read more than:

- How Much Cash Practice You Actually Need To Purchase A Home?

- Why You Should Buy Less House Than You Can Afford

Related Tools

Salve Your Offset - Or Adjacent - $100,000

Sign Up for complimentary weekly money tips to aid you earn and save more

Nosotros commit to never sharing or selling your personal information.

Source: https://www.moneyunder30.com/the-money-pit

Posted by: semanwouspor.blogspot.com

0 Response to "Did I Spend Too Much On My House Money Pit Houses"

Post a Comment